Employee Business Expenses 2024 Deduction

Employee Business Expenses 2024 Deduction – According to the IRS, though, an audit is simply a review of your accounts “to ensure information is reported correctly according to the tax laws and to verify the reported amount . These limits are noted in the table below for both the 2023 and 2024 deductions that taxpayers take include retirement contributions, student loan interest, healthcare expenses, and business .

Employee Business Expenses 2024 Deduction

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

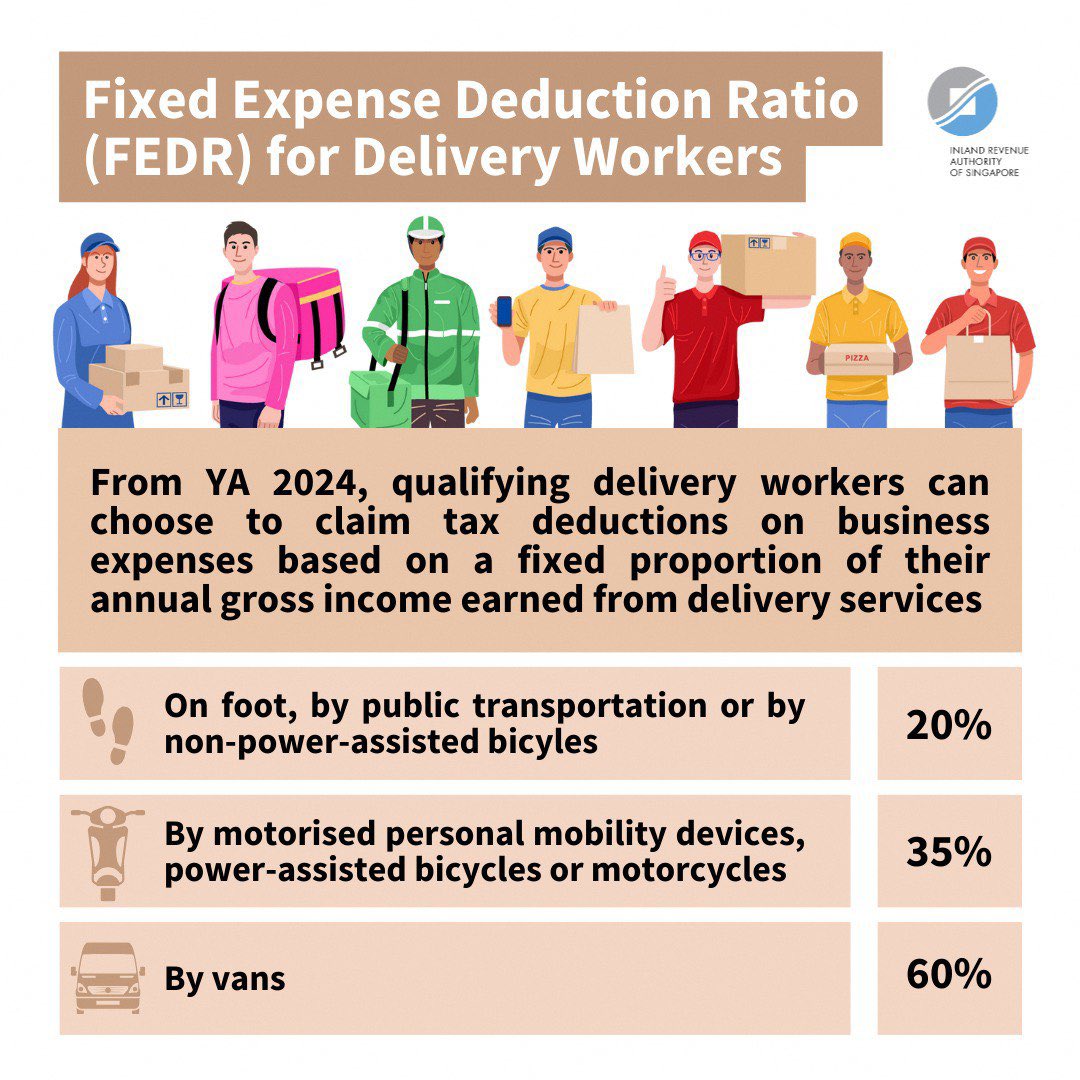

Source : quickbooks.intuit.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comTodd Harrison on X: “🇺🇸 #cannabis 🌿 https://t.co/LEN9R7xeqK” / X

Source : twitter.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.comSelf Employment Tax Deductions and Benefits 2024 Absetax

Source : absetax.comIRAS on Instagram: “Good news for delivery workers! 🙌 With effect

Source : www.instagram.comEmployee Business Expenses 2024 Deduction 25 Small Business Tax Deductions To Know in 2024: JD/CFP® helping LGBTQ entrepreneurs thrive in business and in life you could deduct some work-related expenses even as an employee. That deduction is gone for the time being, but it may . The deduction for tools is applicable if you are self-employed or if you work for someone else and have to provide your own tools. As an employee business owner, you deduct all the expenses .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)